Mortgage rates are crucial to buying a home or refinancing an existing loan. They determine how much you’ll pay each month, the total cost of your home, and, ultimately, whether you can afford the home you want.

Whether you’re purchasing your first home or refinancing an existing mortgage, understanding mortgage rates is vital for making informed financial decisions.

This comprehensive guide will explore mortgage rates in detail, covering how they are determined, the types of rates available, and how they impact your financial future.

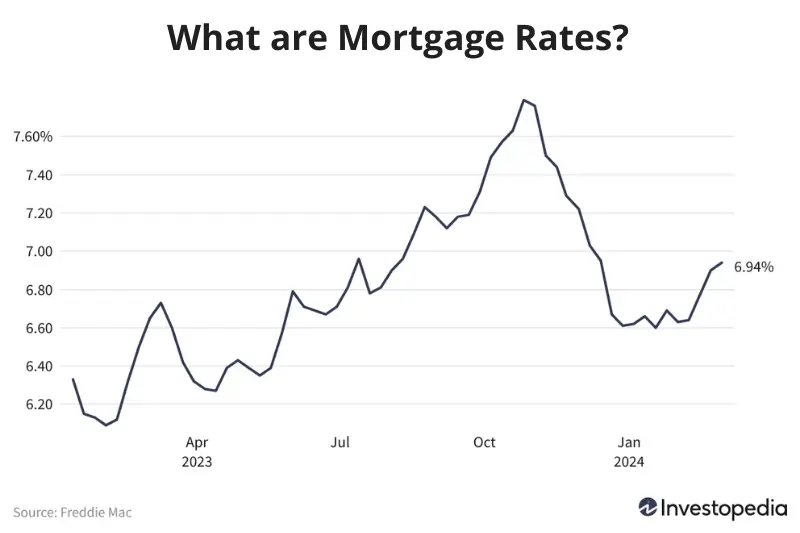

What Are Mortgage Rates?

A mortgage rate is the interest rate charged on a mortgage loan, which is a loan used to buy real estate. When you take out a mortgage, the rate at which you borrow money from a lender is typically expressed as a percentage. This rate affects your monthly payments and the total cost of your home.

The interest rate can vary depending on a variety of factors including the type of loan, economic conditions, and your personal financial situation.

Mortgage rates are typically quoted on an annual percentage rate (APR) basis, which reflects both the interest rate and any additional lender fees or costs.

Types of Mortgage Rates

Mortgage rates can come in various forms, each offering different benefits and risks for borrowers. Here’s an overview of the most common types of mortgage rates:

1. Fixed-Rate Mortgages (FRMs)

A fixed-rate mortgage is one of the most popular types of loans. With this mortgage, the interest rate stays the same for the entire term of the loan, which can range from 10 to 30 years or even longer. This means that your monthly payments, which include both principal and interest, will remain the same for the duration of the loan.

- Pros:

- Predictable monthly payments.

- Stability and peace of mind, as payments will not change over time.

- Good for long-term homeowners who plan to stay in the home for many years.

- Cons:

- Fixed-rate mortgages typically have higher initial rates compared to adjustable-rate mortgages.

- Less flexibility compared to ARMs if the rate environment changes in your favor.

2. Adjustable-Rate Mortgages (ARMs)

An adjustable-rate mortgage (ARM), also known as a variable-rate mortgage, has an interest rate that changes periodically based on the performance of a financial index. Typically, ARMs offer a lower initial interest rate compared to fixed-rate mortgages, but this rate can increase or decrease over time.

- For example, a 5/1 ARM has a fixed rate for the first five years, after which the rate adjusts annually based on the market rate.

- Pros:

- Lower initial interest rate.

- Potentially lower payments in the early years of the loan.

- Good for homeowners who plan to sell or refinance before the adjustable period kicks in.

- Cons:

- The rate can increase significantly after the initial fixed period, leading to higher payments.

- Uncertainty regarding future payments, which can make budgeting more difficult.

3. Interest-Only Mortgages

An interest-only mortgage allows the borrower to pay only the interest on the loan for a certain period, usually 5 to 10 years. After this initial period, the borrower begins to pay both interest and principal. This type of mortgage can make monthly payments more affordable in the short term.

- Pros:

- Lower initial payments during the interest-only period.

- Can be helpful for borrowers with fluctuating incomes or those who expect their income to increase in the future.

- Cons:

- No equity is built up during the interest-only period.

- Payments can increase significantly after the interest-only period ends, which can become a financial burden.

- Not ideal for long-term homeowners unless they refinance after the interest-only period.

4. Government-Backed Loans

These loans are backed by government agencies like the Federal Housing Administration (FHA), the Department of Veterans Affairs (VA), and the U.S. Department of Agriculture (USDA). They usually offer more favorable terms than conventional loans, especially for first-time homebuyers or those with less-than-perfect credit.

- FHA Loans: These are designed for borrowers with lower credit scores or smaller down payments. They typically have lower interest rates but require mortgage insurance premiums.

- VA Loans: Available to military service members, veterans, and their families, VA loans often require no down payment or mortgage insurance, making them a very attractive option for qualified borrowers.

- USDA Loans: These loans are intended for rural and suburban homebuyers who meet certain income requirements. They offer no down payment options and competitive interest rates.

- Pros:

- Lower down payment requirements.

- Lower credit score requirements.

- Potential for lower interest rates.

- Cons:

- Mortgage insurance premiums may be required (especially with FHA loans).

- Eligibility requirements can be strict.

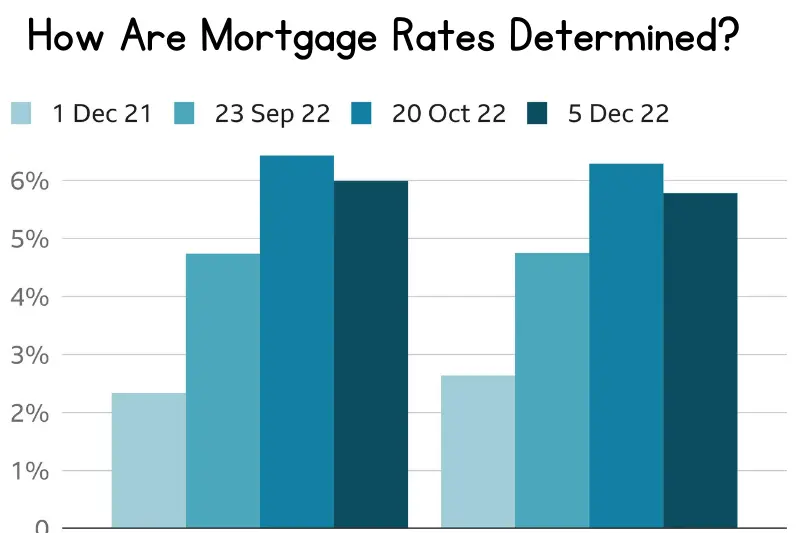

How Are Mortgage Rates Determined?

Mortgage rates are determined by a combination of economic and personal factors that influence the cost of borrowing. Here’s an overview of the key factors that determine mortgage rates:

1. Economic Factors

- The Federal Reserve and Central Bank Policies: Mortgage rates are heavily influenced by the Federal Reserve (Fed) in the United States and other central banks globally. The Fed sets the federal funds rate, which is the rate at which banks lend to each other overnight. When the Fed adjusts this rate, it directly impacts mortgage rates, as banks base their rates on these changes.

- Inflation: Inflation refers to the rate at which the general prices of goods and services increase. When inflation is high, mortgage rates usually rise as well. This is because lenders want to protect themselves from the loss of purchasing power. Conversely, when inflation is low, mortgage rates tend to decrease, helping stimulate borrowing.

- Economic Growth and Employment: A strong economy with low unemployment generally leads to higher mortgage rates because of increased demand for loans. As consumers borrow more to purchase homes or invest, interest rates rise. Conversely, in a weaker economy with higher unemployment, rates tend to drop as central banks aim to encourage spending and investment to stimulate the economy.

2. Personal Factors

- Credit Score: One of the most significant personal factors in determining mortgage rates is your credit score. Lenders use your credit score to assess the risk of lending to you. A higher score (typically 740 or above) indicates that you are a low-risk borrower, qualifying you for lower interest rates. A lower score suggests higher risk, leading to higher mortgage rates to compensate for that risk.

- Loan-to-Value Ratio (LTV): The loan-to-value ratio compares the amount of the loan to the appraised value of the property. A higher LTV ratio (meaning you’re borrowing a larger percentage of the property’s value) increases the lender’s risk, resulting in higher mortgage rates. Borrowers who make a larger down payment, thus reducing their LTV ratio, often qualify for better rates.

- Loan Term: The length of your mortgage term also affects the rate you receive. Shorter-term loans, such as 15-year mortgages, often come with lower interest rates compared to 30-year mortgages. This is because lenders face less risk with shorter loans, as they are repaid more quickly, meaning less time for market fluctuations to affect the loan.

- Type of Loan: The type of mortgage you choose can impact the interest rate. Conventional loans, which are not backed by the government, typically have different rates compared to government-backed loans like FHA, VA, or USDA loans. Government-backed loans usually offer lower rates because they are insured by the government, reducing the lender’s risk.

Understanding the combination of these economic and personal factors will help you make informed decisions when shopping for a mortgage, ultimately allowing you to secure the best possible rate for your financial situation.

How Mortgage Rates Affect Your Finances: Key Insights

Mortgage rates are crucial in determining how affordable a home is and how it impacts your financial future. A small change in interest rates can significantly affect your monthly payments, the total interest paid over the life of the loan, and opportunities for refinancing. Here’s a breakdown of these effects:

1. Monthly Payments

Higher Mortgage Rates:

When mortgage rates rise, your monthly payment increases because a larger portion of your payment goes toward paying interest rather than the loan principal. This means that, even with the same loan amount, higher rates make homeownership more expensive. Higher payments can stretch your budget thin, making it more difficult to afford a home or qualify for a larger loan.

You may also have to cut back on other expenses, adjust your lifestyle, or even reconsider your home purchase plans. The financial strain caused by higher rates is especially noticeable if your income doesn’t rise to meet the higher costs.

Lower Mortgage Rates:

When mortgage rates decrease, your monthly payments go down, as more of your payment is applied to the principal balance. This reduction in payments can make homeownership more affordable. Lower rates may allow you to buy a larger or more expensive property while keeping your monthly costs manageable.

The extra money saved on monthly payments could also be allocated to other financial goals, such as saving for retirement, paying off other debts, or investing. Lower mortgage rates help provide financial flexibility and can ease the pressure on your budget.

2. Total Interest Paid

Higher Mortgage Rates:

A higher interest rate results in paying significantly more interest over the life of the loan. Since a larger portion of each payment goes toward interest rather than principal reduction, the total amount you will pay in interest increases.

For instance, on a $300,000 mortgage with a 6% interest rate, you would pay around $350,000 in interest over 30 years. If the rate were reduced to 5%, you would pay around $275,000 in interest, saving $75,000.

This shows how a seemingly small change in interest rates can make a big difference in the total amount paid over time.

Lower Mortgage Rates:

On the flip side, lower mortgage rates result in less interest paid over the life of the loan. With lower rates, more of your monthly payment goes toward reducing the principal, which in turn reduces the total interest you’ll pay.

For example, if you secure a mortgage at a lower rate, you could potentially save tens of thousands of dollars over the life of the loan.

These savings could be redirected into other areas of your finances, such as investments, savings, or paying down other high-interest debts. The lower the interest rate, the more affordable your mortgage becomes in the long run.

3. Refinancing Opportunities

When Rates Fall:

If mortgage rates decrease significantly, refinancing your mortgage becomes an attractive option. Refinancing allows you to replace your existing mortgage with a new one, ideally at a lower interest rate. For example, if you have a $300,000 mortgage at 6%, refinancing to a 4% rate could reduce your monthly payments by around $367.

This reduction in payments can free up extra funds that can be used for other financial goals, such as saving or paying down higher-interest debt. It’s important to monitor mortgage rates and consider refinancing when rates drop to take advantage of these savings.

Loan Term Adjustments:

Refinancing also provides an opportunity to adjust your loan term. If you want to pay off your mortgage faster, you can refinance to a shorter loan term, such as a 15-year mortgage instead of a 30-year loan. While this might increase your monthly payments, it will save you a substantial amount of money in interest over time.

By paying off the loan faster, you can become debt-free sooner and enjoy long-term savings. However, it’s important to ensure that you can comfortably afford the higher monthly payments that typically come with shorter loan terms.

Consider Costs:

While refinancing can be beneficial, it’s crucial to factor in the costs associated with it. Refinancing usually involves closing costs, such as appraisal fees, origination fees, and other charges, which can add up to thousands of dollars. These costs must be weighed against the potential savings to determine if refinancing is financially worthwhile.

Additionally, refinancing resets the loan term, which could extend the time it takes to pay off your mortgage if you choose a longer term. It’s important to calculate whether the savings from a lower interest rate outweigh the refinancing costs in the long run.

Current Trends in Mortgage Rates (as of Late 2025)

As of late 2025, mortgage rates have risen significantly compared to previous years, primarily due to inflationary pressures and tighter monetary policies implemented by central banks like the U.S. Federal Reserve. These rate hikes were designed to combat inflation, but they have resulted in higher borrowing costs for homebuyers and homeowners looking to refinance.

However, experts predict that mortgage rates may stabilize or decrease slightly in the coming years as inflation is expected to moderate and the economy adjusts to the changing fiscal environment. This could present opportunities for homebuyers to secure more favorable rates in the future, particularly if you’re in the market for a new home or looking to refinance an existing mortgage.

It’s important to stay informed about market trends and compare mortgage offers from various lenders, as even a small difference in rates can make a big difference over the life of your loan. For example, a 0.5% difference in your rate could save you thousands of dollars in interest over a 30-year mortgage.

Conclusion

Understanding mortgage rates is essential for making informed decisions when purchasing a home or refinancing an existing loan. Whether you opt for a fixed-rate mortgage, an adjustable-rate mortgage, or a government-backed loan, each type comes with its own set of benefits and risks. Mortgage rates are influenced by both economic factors, such as inflation and central bank policies, as well as personal factors, including your credit score and loan-to-value ratio.

The impact of mortgage rates on your finances cannot be overstated. Small changes in rates can significantly affect your monthly payments, the total interest paid over the life of the loan, and the opportunities for refinancing. By staying informed about current trends and comparing offers from different lenders, you can secure a mortgage that aligns with your financial goals and helps you manage your homeownership costs.

FAQs

What is a mortgage rate?

A mortgage rate is the interest rate charged by a lender on a mortgage loan, which is used to purchase a home or refinance an existing mortgage. It determines the amount of interest you’ll pay on the loan and influences your monthly payments.

What types of mortgage rates are available?

There are several types of mortgage rates:

Fixed-Rate Mortgages (FRMs): The interest rate remains the same for the entire term of the loan.

Adjustable-Rate Mortgages (ARMs): The interest rate changes periodically based on market conditions.

Interest-Only Mortgages: For an initial period, you pay only the interest, not the principal.

Government-Backed Loans: These are loans supported by government agencies like the FHA, VA, and USDA, offering favorable terms for qualifying borrowers.

How are mortgage rates determined?

Mortgage rates are determined by a combination of economic factors, such as inflation, Federal Reserve policies, and overall economic conditions, as well as personal factors like your credit score, loan-to-value ratio (LTV), and the type of loan you choose.

How do mortgage rates affect my monthly payments?

Higher mortgage rates result in higher monthly payments, as more of your payment goes toward interest. Conversely, lower mortgage rates reduce your monthly payments, making homeownership more affordable and providing more financial flexibility.

Can my mortgage rate change over time?

Yes, with adjustable-rate mortgages (ARMs), the interest rate can change after an initial fixed period, depending on the performance of a financial index. This means your payments could increase or decrease over time.