Have you ever faced the anxiety of an overlooked small bill, or the frustration of an unpaid microtransaction as an online seller? In Korea’s fast-paced digital economy, small-sum non-payments are a common, yet often misunderstood, challenge for both individuals and businesses. The lack of clear guidance on these issues only amplifies the stress, making a deep understanding of the small-sum non-payment policy impact absolutely essential.

This comprehensive guide will demystify Korea’s policy on small-sum non-payments 소액결제 악성미납 정책, providing clear, actionable insights for both individuals and business owners. We will explore the policy’s framework, its consequences, and most importantly, how to prevent and resolve issues effectively.

What exactly is Korea’s Small-Sum Non-Payment Policy?

At its core, Korea’s Small-sum payment malicious non-payment policy is a framework designed to protect businesses particularly in the e-commerce and digital content sectors from intentional and repeated failures to pay for goods or services. A “small-sum” (소액결제) typically refers to microtransactions, often billed through a mobile carrier or a simple online payment gateway.

The policy’s primary purpose is to create a fair commercial environment. However, the consumer impact of payment laws is significant, as the system must balance protecting sellers with ensuring individuals who make an honest mistake aren’t unfairly penalized. It distinguishes between a simple overdue payment and a deliberate act of avoidance.

Defining “Malicious” vs. Accidental Non-Payment

The distinction between an accidental oversight and malicious intent is the most critical aspect of the 소액결제 악성미납 정책. This differentiation determines the severity of the consequences. While official criteria can vary between service providers, the general principles are:

Accidental Non-Payment:

A one-time occurrence due to a forgotten due date.

A failed payment because of an expired card or insufficient funds.

A genuine dispute over the quality of a product or service.

The consumer is responsive and communicates their intent to resolve the issue.

Malicious Non-Payment:

A repeated pattern of non-payment across multiple services or transactions.

Ignoring multiple reminders, emails, and calls from the seller or payment agency.

Providing false contact information at the time of purchase.

Consuming a digital service (like a game or streaming content) with no intention of paying.

Understanding this difference is the first step in effective payment dispute resolution in Korea, as it shapes the approach for both consumers and sellers.

Who is Affected? The Dual Impact on Individuals & Online Sellers

The small-sum non-payment policy impact is a two-sided coin, creating distinct challenges for consumers and sellers. While their immediate problems differ, their paths are interconnected, highlighting the need for a balanced and informed approach. This section explores the impact on online sellers and the consumer impact of payment laws separately.

The Consumer’s Perspective: Navigating Personal Consequences

For an individual, an unpaid small debt might seem minor, but if left unaddressed, it can escalate into significant issues. Understanding the potential risks and your rights is essential for effectively preventing small debt delinquencies.

Here are the key consequences for consumers:

Financial Penalties: The most immediate impact is the accrual of late fees and interest, causing a small debt to grow much larger than its original amount.

Credit Score Deterioration: While an isolated small-sum non-payment may not severely damage your credit, a consistent pattern of delinquency reported to credit agencies can significantly lower your score. This can hinder your ability to secure future loans, credit cards, or even rental agreements.

Service Suspension or Termination: Service providers (such as mobile carriers, streaming platforms, or e-commerce sites) have the right to suspend or terminate your account, restricting access to crucial services.

Potential Legal Action: For substantial or repeated non-payments, sellers may resort to legal action, pursuing the debt through a small claims court.

It’s vital for individuals to be aware of their consumer rights and small debts, which include fair treatment and protection from harassment by collection agencies.

The Seller’s Side: Protecting Your E-commerce Business & Rights

For freelancers, small business owners, and e-commerce operators, unpaid invoices are more than just an annoyance; they are a direct threat to sustainability.

Cash Flow Disruption: The primary impact on online sellers is on their cash flow. A steady stream of small unpaid bills can add up, making it difficult to pay suppliers, marketing costs, and other operational expenses.

Administrative Burden: Chasing down payments consumes valuable time and resources that could be spent on growing the business. This is a common theme in small business payment issues in Korea.

Emotional Toll: Dealing with non-responsive customers can be incredibly frustrating and demoralizing for business owners.

E-commerce Seller Rights: Korean law provides sellers with the right to pursue payment for services rendered. This includes sending official reminders, using collection services, and seeking legal recourse for unpaid small invoices. Freelancer non-payment protection often relies on having strong contracts and clear payment terms from the outset.

Strategies for Prevention & Effective Resolution

The best way to handle non-payment issues is to prevent them from happening in the first place. Whether you’re a consumer or a seller, a proactive approach can save you time, money, and stress.

Proactive management, both in personal finances and in establishing clear business terms, serves as the most effective defense against the challenges of small-sum non-payment.

For Consumers: Proactive Steps & What to Do When Issues Arise

Take control of your finances and protect your standing with these simple steps:

Set Up Payment Reminders: Use your phone’s calendar or a budgeting app to remind you of upcoming due dates.

Enable Auto-Pay: For recurring bills, automatic payments are the surest way to avoid accidentally missing one.

Read the Terms & Conditions: Before making a purchase, understand the payment schedule and any penalties for late payments.

Communicate Proactively: If you know you will miss a payment, contact the seller before the due date. Explain the situation and ask for an extension. This simple act shows good faith and can prevent the issue from escalating.

Seek Professional Financial Guidance: If you’re experiencing financial hardship, avoid letting small debts accumulate. It’s crucial to understand all legitimate options available. Consider consulting with a financial advisor or credit counseling service to explore pathways for debt management and resolution.

By focusing on preventing small debt delinquency, you can maintain a healthy financial life and avoid unnecessary complications. If a dispute arises, remember that clear communication is key to payment dispute resolution in Korea.

For Sellers: Fortifying Your Business Against Non-Payment Risks

Protect your revenue and streamline your operations with these professional strategies:

Establish Clear Payment Terms: Your terms and conditions should be easy to find and understand, clearly stating due dates, accepted payment methods, and consequences for non-payment. This is fundamental to asserting your e-commerce seller rights.

Implement an Automated Invoicing System: Use software to send invoices and automated reminders on a set schedule (e.g., on the due date, 3 days late, 7 days late).

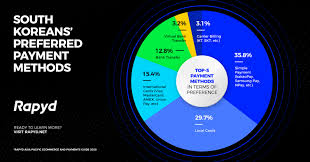

Offer Multiple Payment Options: Make it as easy as possible for customers to pay you by offering various methods like credit cards, bank transfers, and popular Korean payment apps.

Create a Follow-Up Protocol: Have a clear, professional, and firm process for following up on overdue payments. Start with a friendly reminder and gradually escalate the tone and method of communication. Consider creating an internal guide or reviewing a resource on a Business Policy on Unpaid Small-Sum Invoices.

Know Your Legal Options: For persistent non-payment, understand the process for legal recourse for unpaid small invoices. This may involve sending a formal demand letter or, as a last resort, filing a case in small claims court.

These small business payment issues Korea solutions can significantly reduce the frequency and impact of non-payments on your business.

Seeking Support: Where to Find Help and Guidance

Navigating payment issues can be complex. Fortunately, there are resources in Korea dedicated to helping both consumers and businesses.

Korea Consumer Agency : An excellent starting point for consumers involved in a dispute with a business. They can offer mediation and advice on your rights.

Financial Supervisory Service: Provides oversight for financial institutions and offers guidance on financial matters, including credit and debt management.

Legal Aid: For complex situations, seeking small claims legal advice is recommended. Legal aid centers or consulting with a lawyer can provide a clear Korea payment laws explanation and guide you on the best course of action. If you’re unsure where to start, an article on Finding Legal Help for Small-Sum Claims can be an invaluable resource.

Conclusion

Korea’s small-sum non-payment policy is a necessary framework for a healthy digital economy, but its impact is felt deeply by both consumers and sellers. The key to navigating it successfully is understanding, communication, and proactivity.

For consumers, it’s about responsible financial management and open communication. For sellers, it’s about establishing clear processes and protecting your rights. By empowering yourself with knowledge, you can prevent most issues before they begin and resolve the rest with confidence.

Facing small-sum payment challenges? Get personalized, friendly financial guidance from Family Paybank experts. Schedule your free consultation today!