Liquidity represents the ease with which an asset can be bought or sold without significantly affecting its price. In financial markets, including cryptocurrencies, liquidity determines whether trades can be executed efficiently and at predictable prices. It is a foundational concept for all traders because it influences strategy execution, risk management, and portfolio performance. Liquidity is not just a market condition; it is also a trading advantage when leveraged correctly. The ability to quickly convert positions into cash or stable assets connects directly to price efficiency and execution quality. This article explores liquidity from conceptual theory to practical application, providing insights for traders seeking improved outcomes in dynamic markets.

Core Components That Define Market Liquidity

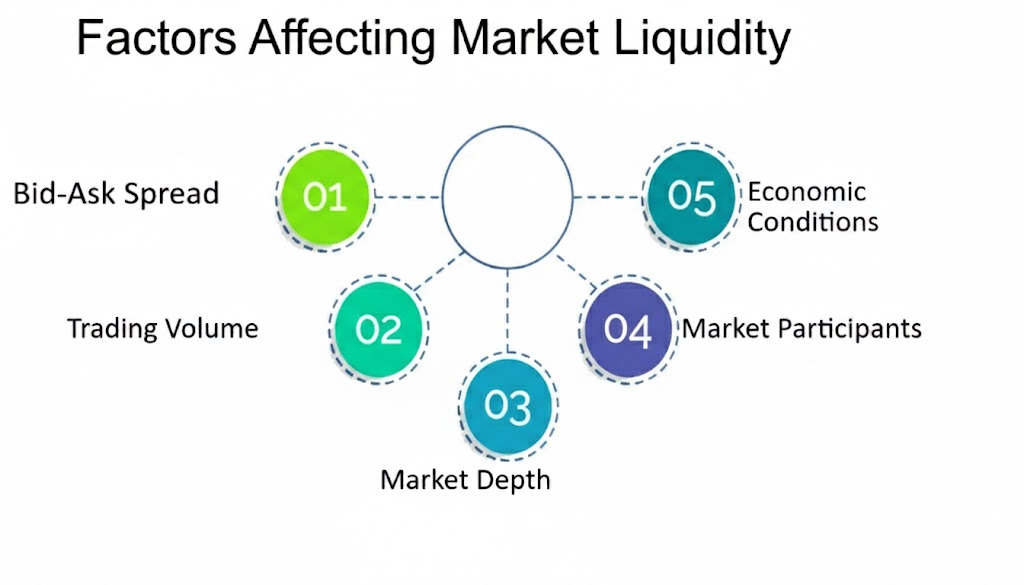

Trading volume serves as the lifeblood of liquidity, reflecting consistent buying and selling interest in an asset. Higher volumes indicate stronger market participation, which allows larger orders to be absorbed with minimal price disruption. Order book depth adds another layer of stability, as multiple layers of bids and asks create a buffer against sharp price swings. The bid-ask spread is a measurable indicator of liquidity; narrower spreads often signal efficient markets with low execution costs. Participant diversity also plays a key role, as the presence of retail traders, institutions, and algorithmic strategies distributes liquidity across multiple layers. Continuous market participation across global time zones ensures that liquidity remains resilient, even during off-peak hours, supporting smoother trading experiences.

Why Liquidity Directly Impacts Spot Trading Performance

High liquidity directly enhances trade execution speed and price accuracy, reducing the risk of slippage. Traders can enter and exit positions confidently when liquidity is robust, minimizing hidden costs that arise in thin markets. Low liquidity environments increase execution risk because even modest orders can move prices significantly. Spot Trading is particularly sensitive to liquidity conditions since the ability to transact immediately determines profitability. Strong liquidity also facilitates fair price discovery, allowing real-time market prices to reflect true supply and demand. Without sufficient liquidity, traders face wider spreads, delayed executions, and elevated risk levels, all of which undermine long-term trading success.

Liquidity Structures Across Different Spot Market Environments

Centralized exchanges generally provide concentrated liquidity, offering tighter spreads and faster order execution. Fragmented liquidity, by contrast, occurs when the same asset is spread across multiple venues, potentially increasing slippage. Token maturity strongly affects liquidity; older, widely adopted cryptocurrencies tend to have deeper markets than newly launched tokens. Market cycles also influence liquidity levels. During accumulation phases, liquidity tends to increase as investors gradually build positions. Distribution phases can produce volatility as sellers dominate the market. Stablecoin pairs often act as liquidity anchors, enabling traders to switch between assets with minimal price disruption. Global participation enhances liquidity consistency, as overlapping activity across regions reduces periods of stagnation and ensures smoother price movements.

Key Liquidity Metrics Spot Traders Should Monitor

- Bid-ask spread behavior during normal and volatile conditions.

- Order book depth at multiple price levels

- Volume consistency over short and long time frames

- Trade frequency and market activity density

- Price impact of medium-sized market orders

These metrics must be interpreted collectively rather than in isolation. For example, a narrow bid-ask spread may appear attractive, but if order book depth is shallow, trades could still experience slippage. Volume consistency ensures that liquidity is sustainable, not just momentarily high. Trade frequency and market activity density reveal the market’s dynamism, while the price impact of medium-sized orders highlights potential execution risks. Evaluating these metrics together provides a comprehensive view of liquidity quality, guiding smarter trading decisions.

Relationship Between Liquidity and Market Volatility in Spot Trading

High liquidity can absorb large orders without creating sharp price swings, stabilizing markets during heavy trading. Conversely, low liquidity amplifies volatility, as even modest trades can trigger exaggerated price movements. Volatility spikes often trigger temporary liquidity withdrawals, creating a feedback loop that further intensifies price swings. During major news or macroeconomic events, liquidity conditions can shift rapidly, requiring traders to adapt strategies dynamically. The table below summarizes typical liquidity conditions and their trading implications.

| Liquidity Condition | Typical Spread Behavior | Execution Quality | Volatility Sensitivity | Trader Risk Level |

| High liquidity | Narrow and stable | Fast and precise | Low | Lower |

| Moderate liquidity | Variable | Acceptable | Medium | Moderate |

| Low liquidity | Wide and unstable | Delayed or partial | High | Elevated |

This framework illustrates how liquidity directly affects execution, risk management, and volatility exposure in spot markets. Traders can use these insights to anticipate challenges and adjust position sizing, entry timing, and order types appropriately.

How Professional Spot Traders Integrate Liquidity Into Strategy Design

Position sizing is often adjusted based on market liquidity to avoid unintended price impact. Traders time their orders to align with periods of peak liquidity, ensuring faster execution and reduced slippage. Limit orders become a strategic tool in liquid markets, allowing controlled entry and exit points without disrupting prices. Portfolio rebalancing relies heavily on liquidity awareness, as thin markets increase cumulative transaction costs. Professional traders continuously evaluate liquidity metrics to optimize trading efficiency and preserve capital. Integrating liquidity considerations into strategy design supports sustainable performance, risk management, and disciplined execution.

Leveraging High Liquidity Infrastructure Through Zoomex for Spot Trading Success

Zoomex, founded in 2021, is a global cryptocurrency exchange emphasizing speed, stability, and deep liquidity. Its professional-grade infrastructure supports consistent market participation, offering reliable execution across various spot trading pairs. Real-time data and accurate pricing enhance trader confidence, minimizing slippage and enabling precise strategy implementation. Diverse trading pairs attract continuous activity, reinforcing liquidity even during volatile periods. Security, compliance, and user-centric design contribute to sustainable liquidity, protecting assets and maintaining market integrity. By leveraging high-performance systems and global reach, Zoomex aligns closely with the needs of serious traders seeking stable, liquid markets for optimal results.

Conclusion

Liquidity serves as a core determinant of execution quality, risk management, and overall profitability. Understanding its mechanics empowers traders to make informed decisions and anticipate market behavior. Consistently monitoring liquidity metrics provides insight into both opportunities and potential risks. Selecting trading environments that prioritize depth, transparency, and stability enhances long-term performance. Mastering liquidity awareness ensures that trading strategies remain effective across diverse market conditions, laying the foundation for sustainable success in spot trading.