Managing finances efficiently is essential for businesses, and QuickBooks provides powerful tools to simplify tasks like bank transfers. Whether you’re moving funds between accounts or paying vendors, QuickBooks makes the process seamless. Streamlining bank transfers not only saves time but also ensures accuracy and proper tracking, which are vital for maintaining financial health.

This guide outlines how to use QuickBooks to manage bank transfers effectively, the benefits of using the software for these transactions, and tips for optimizing the process.

Understanding Bank Transfers in QuickBooks

A bank transfer in QuickBooks involves moving money from one account to another, either within your organization or to an external bank account. QuickBooks supports various types of transfers, including:

- Internal Transfers: Moving funds between two accounts within the same business.

- External Transfers: Sending money from your business account to a vendor, contractor, or other external recipient.

QuickBooks integrates with banks to provide real-time transaction processing, allowing you to manage transfers directly from the platform.

Steps to Transfer Money Using QuickBooks

Follow these steps to complete a bank transfer in QuickBooks:

1. Log In to QuickBooks

- Access your QuickBooks account and navigate to the dashboard. Ensure you have administrative privileges to perform financial transactions.

2. Select the Transfer Option

- From the main menu, go to Banking or Transactions (depending on your QuickBooks version).

- Click on Transfer Money or a similar option.

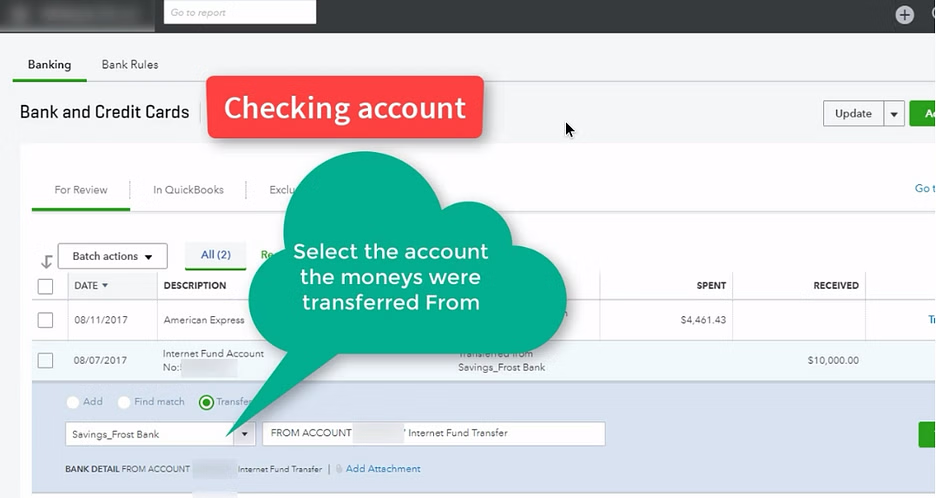

3. Choose Accounts

- Specify the account you’re transferring money from and the account you’re transferring money to. For external transfers, ensure the recipient’s bank details are correctly added.

4. Enter Transfer Details

- Input the transfer amount and add a description or memo for easy identification in future records.

- Select the transfer date. QuickBooks allows you to schedule transfers if needed.

5. Review and Confirm

- Double-check all details before confirming the transfer. This step is crucial to avoid errors.

- Submit the transfer request. QuickBooks will process the transaction and update your records automatically.

6. Reconcile Accounts

- After the transfer is complete, reconcile your accounts to ensure your financial records are accurate.

Benefits of Using QuickBooks for Bank Transfers

1. Time Efficiency

QuickBooks simplifies the transfer process, reducing the time spent on manual entries and reconciliation. You can manage multiple accounts and process transfers with just a few clicks.

2. Accuracy

Manual processes are prone to errors, but QuickBooks reduces these risks by automating calculations and ensuring that account balances are updated instantly.

3. Seamless Integration

QuickBooks integrates with most banks, allowing real-time synchronization of transactions. This integration ensures that your transfers are reflected in both QuickBooks and your bank account without manual intervention.

4. Improved Record Keeping

Every transfer made through QuickBooks is automatically recorded, including details like the amount, date, and recipient. This feature helps in maintaining transparent financial records.

5. Customization and Control

QuickBooks allows you to categorize transfers and add memos, making it easier to identify the purpose of each transaction during audits or reviews.

Tips for Streamlining Bank Transfers in QuickBooks

1. Link Your Bank Accounts

Ensure that all your business bank accounts are linked to QuickBooks. This setup enables automatic syncing, making the transfer process faster and more efficient.

2. Schedule Regular Transfers

For recurring payments, such as rent or vendor payments, use QuickBooks’ scheduling feature. This tool automates transfers, ensuring timely payments without manual effort.

3. Use Multi-Currency Features

If you manage international transactions, leverage QuickBooks’ multi-currency support. It calculates exchange rates automatically, simplifying cross-border transfers.

4. Set Up Alerts

QuickBooks can notify you of pending or completed transfers. Enable these alerts to stay informed about your financial activities.

5. Reconcile Frequently

Regular bank reconciliation ensures your records are up-to-date and helps identify any discrepancies quickly.

Troubleshooting Common Issues

While QuickBooks is designed to make bank transfers seamless, you may encounter occasional issues. Here’s how to address them:

1. Transfer Delays

If a transfer is delayed, verify that your bank account is properly linked, and check for any processing times imposed by your bank.

2. Incorrect Details

If you notice errors in the transfer details, cancel the transaction immediately (if possible) and re-enter the correct information.

3. Integration Problems

Sometimes, bank integrations may disconnect. Reauthorize the connection by logging into your bank account through QuickBooks.

Conclusion

QuickBooks makes bank transfers simple and efficient, reducing the time and effort needed to manage financial transactions. With its intuitive interface and robust features, you can streamline the transfer process, improve accuracy, and maintain detailed records. By linking your bank accounts, scheduling recurring transfers, and reconciling frequently, you can ensure smooth financial management and focus on growing your business.