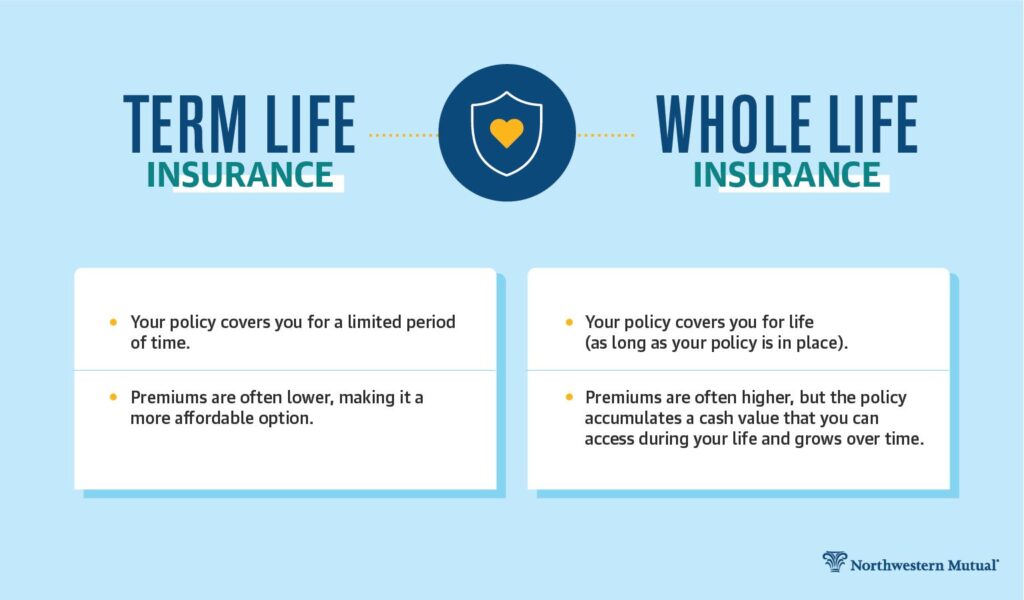

Unlike long-term insurance plans, which provide coverage for a long period, there is also a term insurance plan that offers coverage from 1 to 10 years, known as Short-Term Insurance. It offers financial protection in any unfortunate event with a specific purpose during the policy period. It is a pure protection plan, which means it neither accumulates cash nor includes a savings component. In case the insured dies during the coverage period, the nominee will receive the amount of death benefit.

Right Time to Consider a Short-Term Insurance Policy

A short-term insurance plan should be considered if:

- Any Unpaid Debts

It should be considered in case you have any unpaid debts and obligations that the family would have to pay in your absence.

- Only a few years are left until retirement.

If you go by the term plan meaning, it basically is financial coverage provided for the working years of the insured. Also, if your retirement is close and only a few years are left, a short-term insurance plan can be availed.

- A senior citizen whose life insurance is expiring soon

If you are nearly 60 years of age and your life insurance plan expires soon, plan to buy a short-term plan to fulfil the insurance requirements.

- The time to meet the financial liabilities is approaching.

A short-term plan can be a lifesaver against uncertainties of unexpected events such as children’s education or marriage.

Advantages of Short-Term Life Insurance

Provided below are the features of a Short Term Insurance Plan:

- Low Premium

Though the premium amount depends upon policy tenure and the sum assured, since there is no investment component involved in short-term insurance plans, they come with a low amount of premiums.

- Add-on Coverage

Some additional covers may also be availed, such as permanent disability, accidental death, critical illness, etc.

- Critical Illness Riders

Get a lump sum amount once the critical illnesses are discovered.

- Permanent Disability Riders

Get a fixed amount of sum in case the insured gets a permanent disability as a result of an accident.

- Accidental Death Benefit Riders

In the event of an unfortunate death occurring due to an accident, death benefits and additional payouts are provided to the nominees of the insured.

- Tax Benefit

Get an income tax deduction u/s 80 C of the Income Tax Act, 1961, for the premium paid towards the short-term insurance plan. The death benefit amount paid will not attract any tax liability u/s 10(10D) of the Income Tax Act, 1961.

- Surrender Benefit

A surrender benefit can be availed if the policy is surrendered before the maturity date.

Factors to be considered while purchasing a short-term plan

- Policy Tenure

Firstly, you should decide the period for which you want coverage, whether short-term or long-term and then decide accordingly. If the desired period is less than 5 years, opt for a short-term policy.

- Coverage Amount

Decide the insurance coverage you desire, i.e. small or medium. If you want yourself to be covered for a shorter period, go for a short-term plan.

- Frequency of Premium

Decide how often you want the premium payment to be made and for how long it will last. If you decide to pay a low premium for a shorter period, opt for a short-term plan.

- Life Stages and Dependents

Analyse at which stage of life you plan to buy an insurance. This depicts that some factors, such as age, marital status, financial status, etc., help in deciding the policy tenure, coverage amount, etc.

- Lifestyle

Your choice, spending patterns, habits, and standard of living are some of the factors that help to determine the extent to which your future expenses can go. If you can successfully assess the same, you will be efficient in securing your family’s future. One can safeguard the family’s future quite well if they have a clear perception of all these factors in mind.

- Income

One should also take various income sources along with financial commitments into consideration. If you are not capable enough to pay a high premium, do not opt for big policies. Hence, the same should be calculated correctly, or else you will end up making the wrong decision.

- Liabilities

Your liabilities, debts and financial obligations are also deciding factors that help determine the term insurance plan. If you have debts and obligations that need to be repaid in the long run, it can be a financial burden for your family members in your absence. Hence, consider your liabilities when deciding on insurance. Also, the claim settlement ratio gives a fair idea of the capacity of the insurer company to settle the claims.

Different Modes to PurchaseShort-term Life Insurance Plans

Provided below are the different modes of buying a short-term insurance plan:

- Online Mode

Open the insurance company’s website from where the insurance is to be bought. After comparing different short-term insurance plans, choose the one policy that best suits your requirements. Fill out the details mentioned in the form and proceed to make the payment. The policy details will be sent via e-mail.

- Offline Mode

One is required to visit the insurance company’s office and speak to the advisor about your requirements out of the plan. After finalising a short-term plan and vigilant consideration, provide the details as required in the form along with your signature. Once the payment is made, you will be required to send the policy documents via e-mail or post.

Conclusion

If you require temporary insurance coverage, short-term insurance plans are the best choice. This plan is meant for individuals who have short-term liabilities or financial obligations to protect their families in case of a sudden demise. They are also quite an affordable option if compared with long-term insurance plans. As the period it covers is shorter and the premium amounts are lower, it is an attractive deal for those who have a low budget capacity.